Payroll management refers to the overall administration of employee salaries, wages, benefits, and deductions. It includes tasks such as salary disbursement, ensuring tax compliance, handling employee benefits, and managing payroll accounts. Bank Alfalah’s Employee Banking program simplifies payroll management by offering services like hassle-free payroll account setup, free banking services, and a dedicated Relationship Manager to support businesses and employees in managing their finances efficiently.

FAQ’s – Employee Banking – The Bank Alfalah Way

Salary disbursement refers to the process of transferring an employee’s salary directly into their designated payroll account. This is a key part of payroll management, where companies ensure that employees receive their wages in a timely and secure manner. With Bank Alfalah’s Employee Banking program, employees benefit from a streamlined disbursement process through easy payroll account setup, ensuring smooth and efficient salary payments.

A salary run is the process of calculating and processing the salary payments for employees over a defined period (typically monthly or bi-weekly). During a salary run, companies assess the total wages, deductions, and benefits to determine the final payment for each employee. Bank Alfalah’s Employee Banking services assist companies in facilitating this process by providing payroll accounts with no minimum balance requirements and offering a range of digital banking tools to support both employees and employers during the salary run.

The Bank Alfalah Employee Banking program is a specialized corporate payroll solution designed for salaried employees in Pakistan. It provides a range of payroll account solutions, offering exclusive banking benefits and convenient salary runs through corporate payroll accounts at partnered institutions.

Employees of corporate clients or organizations that have partnered with Bank Alfalah for corporate payroll services are eligible to enroll in the Employee Banking program, through which employee salaries are disbursed. This program offers payroll account facilities and employee banking benefits to salaried individuals.

The Employee Banking program offers numerous benefits apart from employee salary disbursement, including:

- Free cheque book and debit card for employees

- Free ATM withdrawals from any bank’s ATM across Pakistan

- Free banker’s cheques, bank statements, and certificates

- Free internet banking and registration for the Alfa mobile app

- Complimentary insurance coverage, including accidental death and protection for your mobile, wallet, and IDs

- Telehealth services for employees, offering at home video consultations, medicine delivery, and lab tests

- Access to a dedicated relationship manager for personalized payroll account services

No, there is no minimum balance requirement for opening a payroll account under the Employee Banking program. This makes it easier for employees to manage their corporate salary accounts without the pressure of maintaining a minimum balance.

Yes, Bank Alfalah provides on-site account opening services for employees as part of its corporate payroll solutions. You can set up your payroll account directly at your office, allowing you to enjoy employee banking services without leaving the workplace.

Most services under the Employee Banking program are free; however, some services like locker facilities, interbank fund transfers, and ATM withdrawals outside Pakistan may have applicable charges. Refer to the Bank Alfalah Schedule of Charges (SoC) for further details about corporate payroll account service charges.

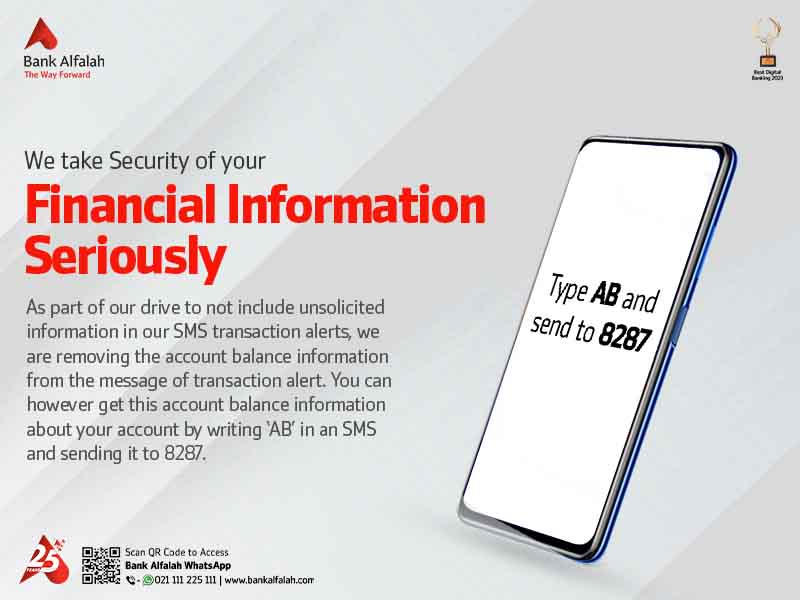

You can access your payroll account easily using Bank Alfalah’s Internet Banking platform or by downloading the Alfa mobile banking app. These digital banking options give you convenient access to your banking services, account statements, transactions and allow you to track your salary disbursement from anywhere.

Employees enrolled in the Employee Banking program receive complimentary insurance coverage for accidental death, mobile, wallet, and IDs. Employees also have access to telehealth services, including video consultations and lab tests and medicine delivery at home, as part of their corporate payroll benefits.

Debit cards are delivered directly to your workplace as part of the on-site payroll services offered by Bank Alfalah. To collect your cheque book, simply bring your Letter of Thanks or Debit Card Letter to your designated branch.

Each employee who enrolls in the Employee Banking program receives a dedicated relationship manager to help with their payroll account services. Your relationship manager will assist you with all aspects of corporate payroll management and provide personalized financial solutions tailored to your needs.

Yes, as a participant in the Employee Banking program, you can make free ATM withdrawals from any Bank Alfalah ATM across Pakistan. This feature allows employees to conveniently access their corporate payroll funds without incurring additional charges.

For more details about the Employee Banking program or to enroll in our corporate payroll solutions, please contact us at employee.banking@bankalfalah.com or call 111 225 111. Our team will be happy to assist you with your payroll account setup and other employee banking services.